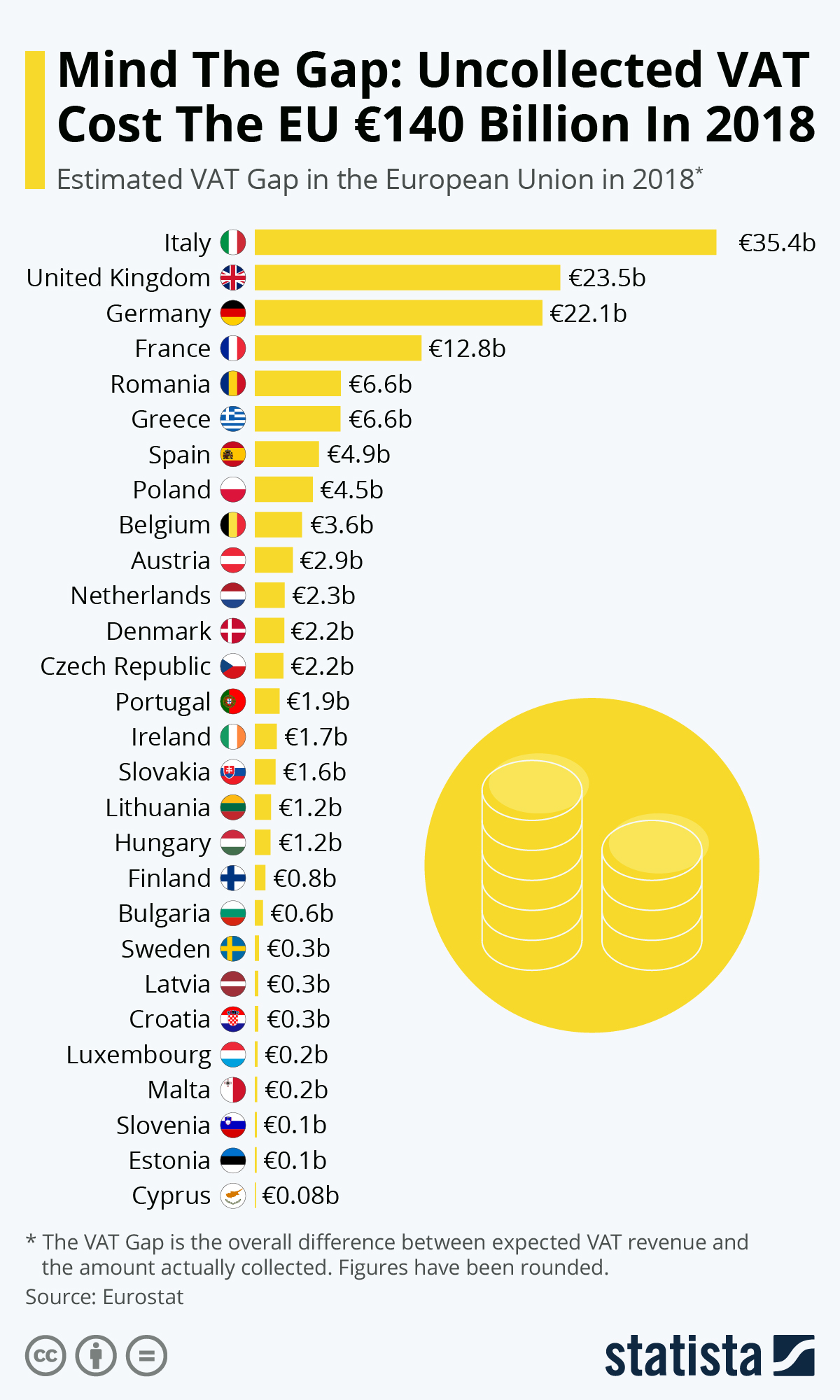

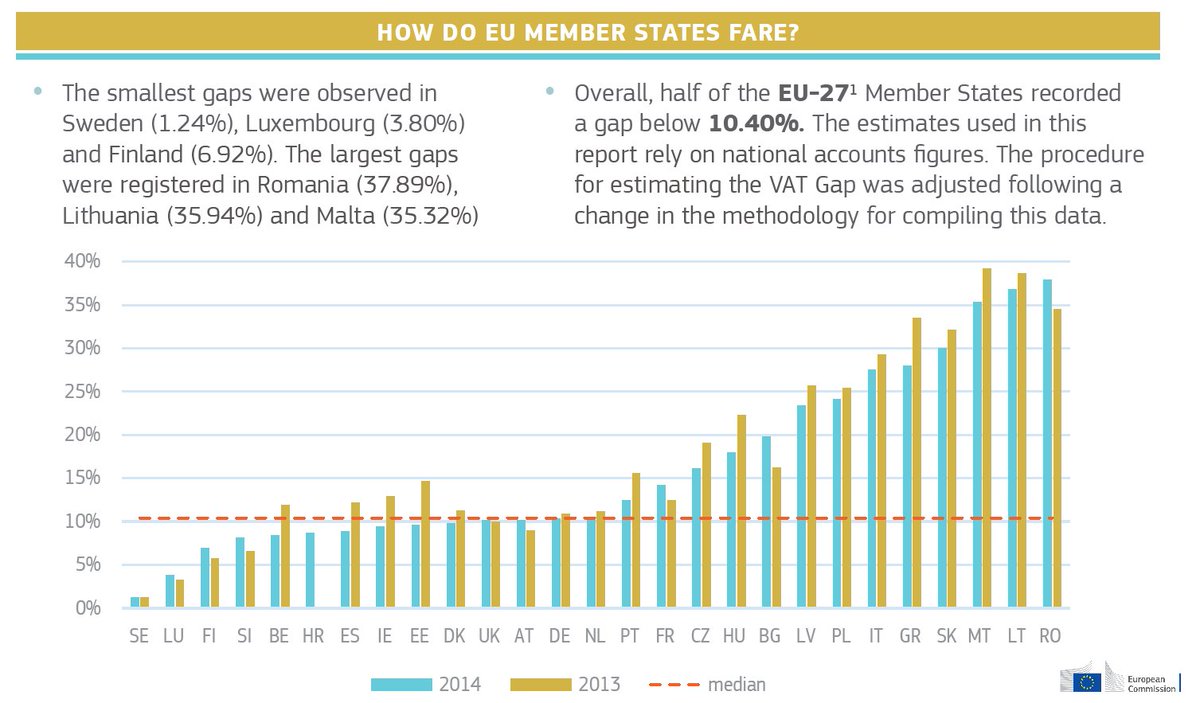

European Commission 🇪🇺 on Twitter: "What is the VAT Gap? | Main findings of the 2016 Report | Estimates per Member State → Q&A: https://t.co/IQBiB37f21… "

European Commission 🇪🇺 on Twitter: "EU countries lost almost €150 billion in #VAT revenues in 2016, according to our new study. They have been reducing this 'VAT Gap', but a substantial improvement

European Commission 🇪🇺 on Twitter: "What is the VAT Gap? | Main findings of the 2016 Report | Estimates per Member State → Q&A: https://t.co/IQBiB37f21… "

VAT Fraud in Selected European Union Countries and Its Possible Macroeconomic Implications | SpringerLink