VAT Fraud in Selected European Union Countries and Its Possible Macroeconomic Implications | SpringerLink

Collection Dilemmas and Performance Measures of the Value-Added Tax in Germany and Poland in: International Journal of Management and Economics Volume 54 Issue 2 (2018)

Collection Dilemmas and Performance Measures of the Value-Added Tax in Germany and Poland in: International Journal of Management and Economics Volume 54 Issue 2 (2018)

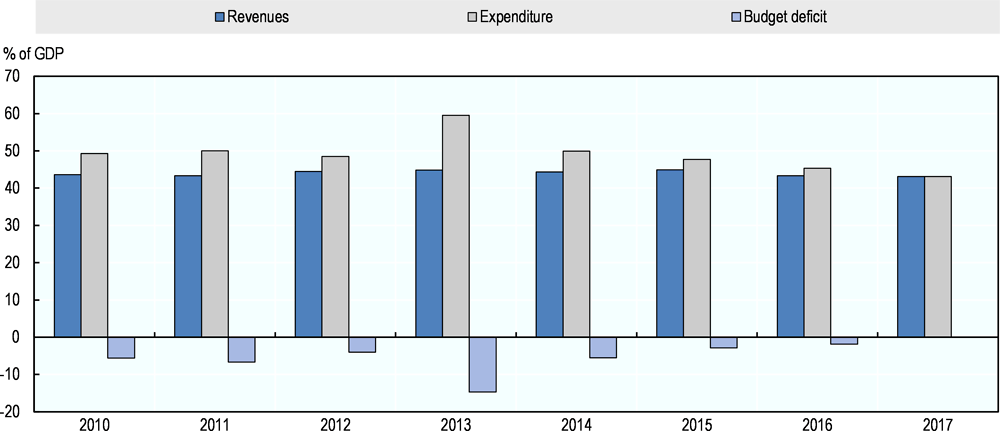

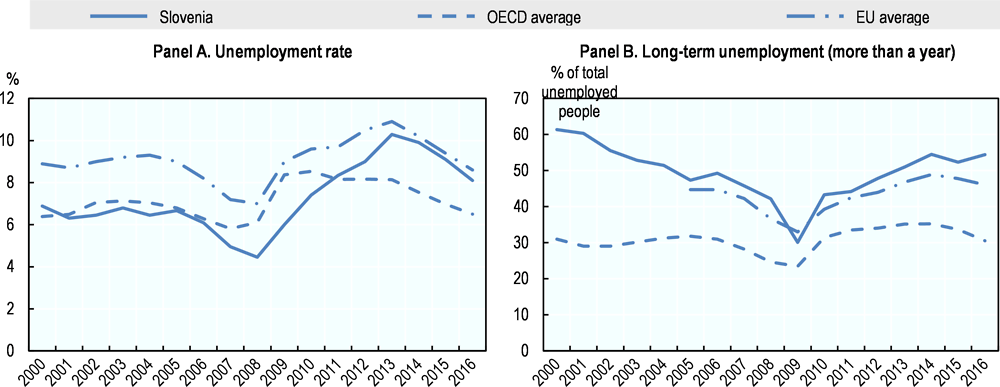

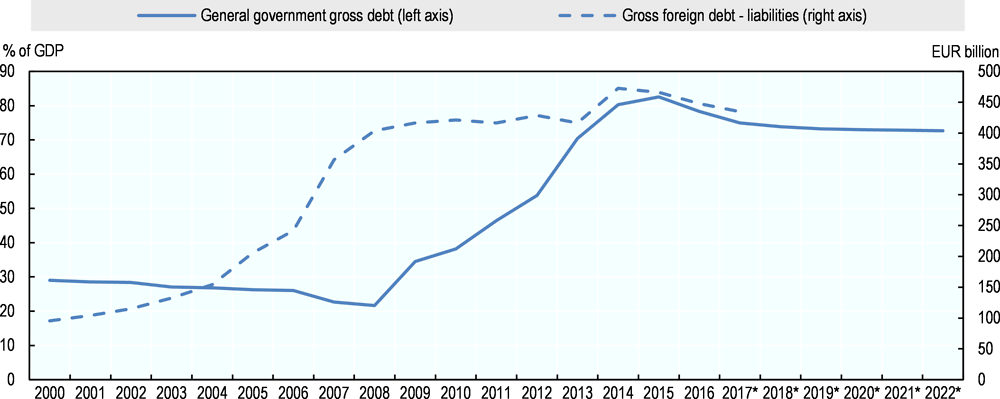

Greece: 2019 Article IV Consultation—Press Release; Staff Report; and Statement by the Executive Director for Greece : Greece : 2019 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director